Shifting Business Models Disrupt the Automotive Industry

This blog has been written as prelude for an upcoming presentation at the Canadian Automotive Dealer Association (CADA) Summit on February 13, 2019 in Toronto, Ontario. It is the first of a two-part series applying the principles from the book, “Competing in the Connecting World” to the automotive industry as it morphs into the into the mobility industry.

In our book, Competing in the Connecting World, Gregg Garrett and I describe a recurring industry phenomenon, whenever there is a technological discontinuity (when a new technology supersedes a dominant current technology) some executives will envision the potential to adapt their existing business models, enhance their product or service offering and shift the basis of industry competition. Many will not. Then, there will be a subsequent period of industry disruption as other companies race to transform themselves by acquiring the necessary capabilities to adjust their own offerings. Some companies will be faster and better at the transformation than others. When the dust settles new industry leaders will likely be in place, and a new order established. Some companies will be larger, and others will be smaller. Significant technological change will create winners and losers within industries and the changes are not temporary. We call this sequence of events the Discontinuity to Disruption Cycle.

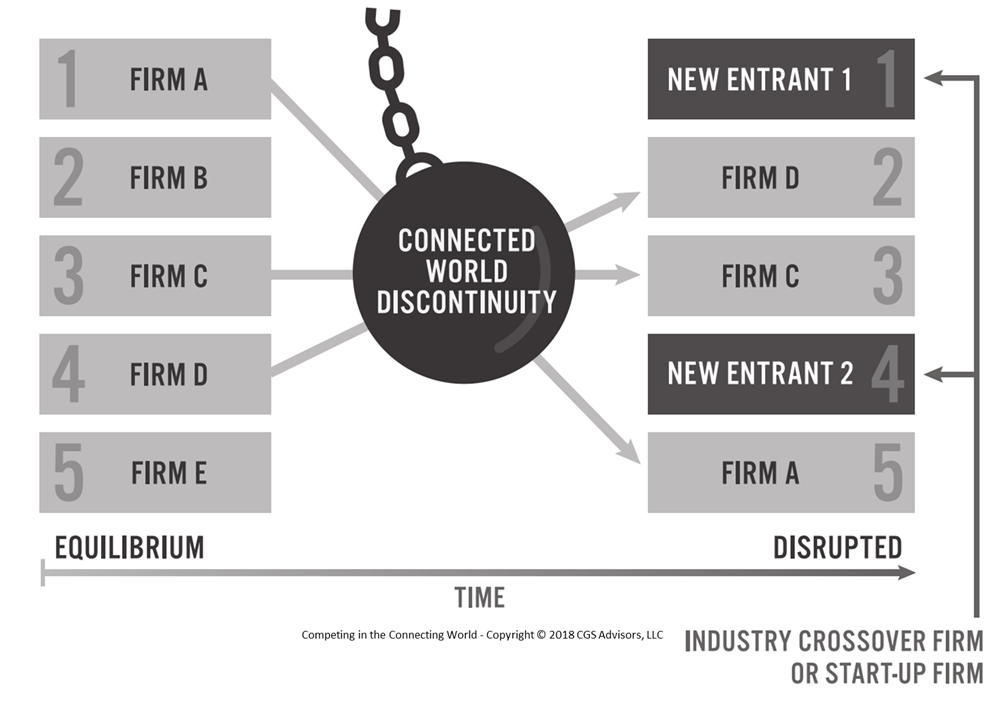

But there is something else that can occur, if the technological discontinuity is of such a magnitude that the product and service offering enhancements are so perceptively different that it may lower the barriers to industry participation and new entrant companies may move in from other industries. Sometimes these new entrants bring a greater willingness to invest in the new capabilities necessary and sometimes they may already have some of the necessary capabilities already in existence for use in their current outside industry. The result can be that the new entrants previously not participating in the industry occupy very prominent positions in the new disrupted industry order. This phenomenon has repeated over time and it is now an underlying force in driving the change in competition occurring in the emerging connecting world. We created a very simple graphic (Figure 1 below) included in the book to illustrate the before and after effects of a disrupted industry.

Figure 1 – Industry Disruption (from Competing in the Connecting World)

Now, let’s run the Discontinuity to Disruption Cycle, applying the connecting world technologies to the current automotive industry. The core technology manifestation underlying the emerging connecting world is a category of technologies often simplified down to the general term, the internet of things. Just to keep the terms simple, we define the internet of things as the phenomena that occurs when the “internet world” meets the “world of things”. It is a merger of different business universes and dramatically different economic foundations. Embedding sensors in vehicles that can communicate over the air aspects of a vehicle’s operational performance as well as the driver’s location and driving preferences is creating the potential for products to talk digitally to the OEM, the dealer, other cars, personal devices and really almost anyone and anything else. The connected car represents a real technological discontinuity. Someday, people will look back and define the automobile in two eras, the one before cars were connected and the one after. The difference in the potential value of a connected vehicle is just that significant.

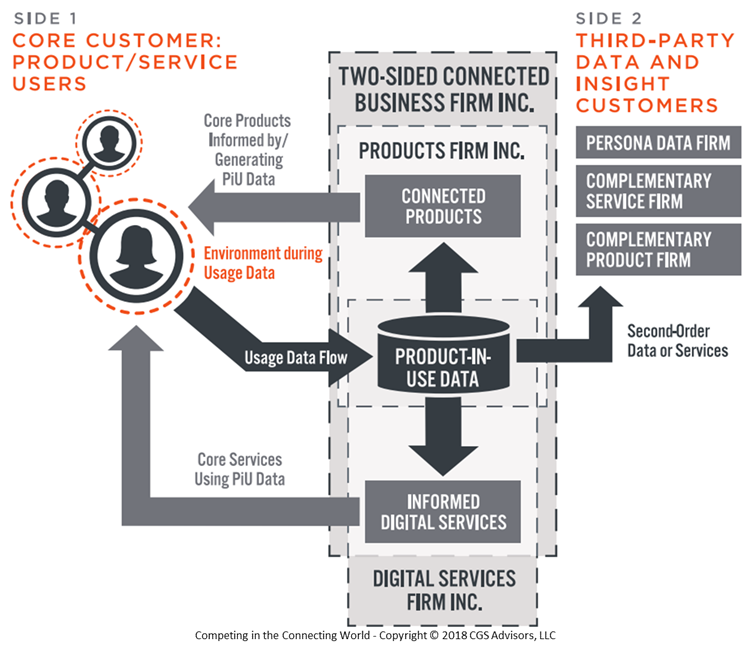

Connected vehicles, like other connected products, actually create value in two directions and offer the opportunity to monetize that value in both directions. This has led to the connected vehicle business model to be termed a 2-sided platform model (see Figure 2 below) On the Side 1, connected vehicle data enables the creation of vehicle in use services created typically by the OEM and consumed directly by the users of the vehicles (e.g driver, passenger). Side 2 of the platform is created from the usage data of vehicle users that creates a profile or persona of the user(s) that can be offered to 3rd party businesses who are interested in using that data to advertise or as part of another non-OEM consumer intelligence offering. The two-sided platform business model is very common within the internet world (Facebook, Apple, Google, Amazon) but it is relatively new to auto OEMs. In fact, the majority of the internal capabilities necessary to manage the two-sided platform model of connected vehicle services currently exist within large internet based digital companies and have historically not existed in the auto industry.

Figure 2 – 2-Sided Business Model from Competing in the Connecting World

So, the question becomes should every auto OEM try to manage the digital and IT operations of its own connected vehicle program? In the short term, the answer seems to be, yes, as more or less every OEM has launched a service offering of their own. However, to be transparent the quality and effectiveness of these offerings varies widely, and the market reaction has been lukewarm at best for some manufacturers. Some OEMs clearly misunderstood the economics of internet services and rather than focus on building a community of users to be monetized, sought to monetize each, and every user as they join through a subscription fee. The result being low user participation and no user community. In short, they failed to build side 1 of the platform so there is no opportunity to develop side 2. The opportunity to understand how every vehicle is performing in real time and how every customer is using the vehicle is missed because of the short-term desire to recover development costs of the service. Ironically, the up-front subscription fee model has generally not even resulted in cost recovery of the development. OEMs have used industrial era economic thinking on an internet era economic opportunity. It failed. This is not surprising given that auto OEM’s historically have not dealt with two-sided platform models nor possessed the internal capabilities to develop and deliver such customer data centric services. To be fair, however, this initial failing is being corrected as more OEM’s relaunch their next generation offerings they are making the connected service offering available at no incremental cost to the vehicles. They have clearly figured out that the short-term goal must be to build the user community first before they look to monetize it. It was a costly error for many auto OEMs. One that could have been avoided, if they had considered that they were entering an internet-based service business as opposed to still being in the vehicle hardware business. Thirty minutes thinking about the Facebook business model would have likely been sufficient to avoid millions of dollars wasted. But, that’s not the nature of the dominant logic in the auto industry, which suggests that everything that is part of the vehicle is a product feature.

Dr Warren Ritchie is a Fellow in CGS Advisors’ strategic transformation practice where he advises an elite group of clients on dynamic market issues, and strategic changes necessary to grow. He has over 30 years of experience in automotive industry, where has held C-level leadership positions with automotive OEMs in North and South America. In 2018 he co-authored the best-selling business book, Competing in the Connecting World.